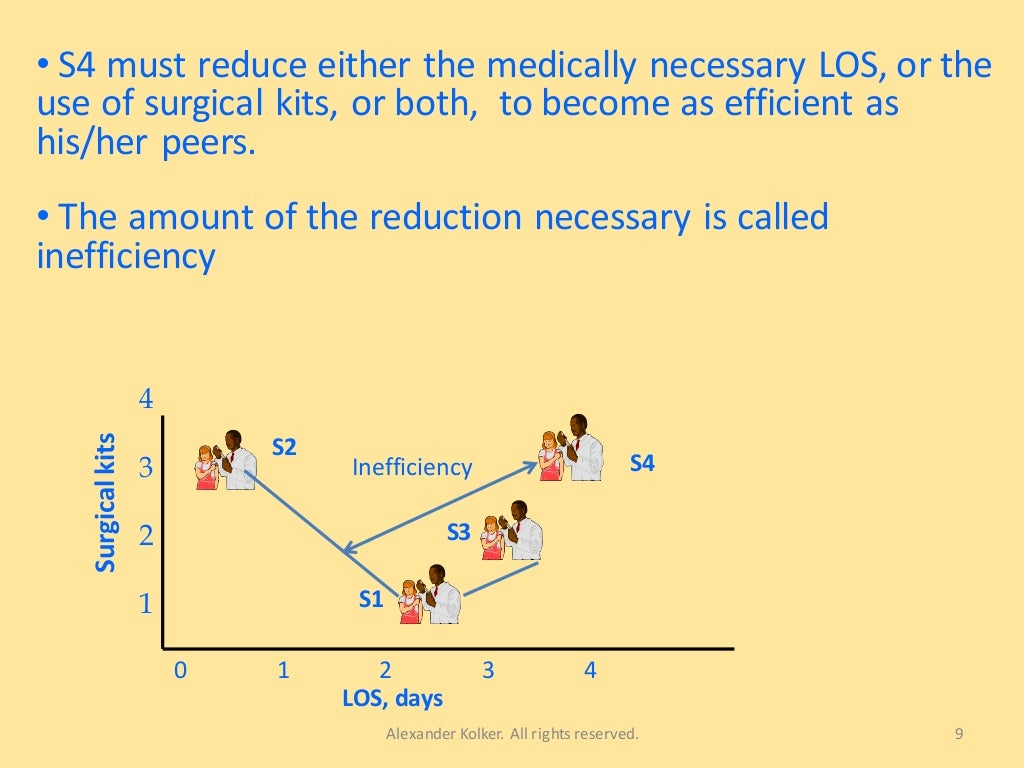

The focus is directed rather to efficiency of performances in the presence of inefficiencies imposed by, say, labor contracts or government regulations and policies. The treatment here differs from the usual approaches that are restricted to identifying sources and amounts of technical inefficiency and congestion to be eliminated. DEA is also used to identify where improvements may be made in the management of congestion and to estimate input decreases and output increases that may be made after managerial inefficiencies in managing congestion are eliminated. For this purpose, DEA (Data Envelopment Analysis) is used to identify congestion when the data show it to be present, estimate its amounts, and separate it from other forms of inefficiency.

This paper deals with identifying and managing congestion. A new DEA approach and interpretation is also presented. Comparisons with the “value-added” or “production” approach to insurer efficiency are presented. These efficiency evaluations are further examined to study stock versus mutual form of organizational structure and agency versus direct marketing arrangements, which are examined separately and in combination. Accordingly, we investigate the efficiency of insurance companies using data envelopment analysis (DEA) having as insurer output an appropriately selected (for the firm under investigation) combination of solvency, claims-paying ability, and return on investment as outputs. The financial intermediary approach acknowledges that interests potentially conflict, and the strategic decision makers for the firm must balance one concern versus another when managing the insurance company.

These three variables (solvency, financial return, and claims-paying ability) are considered as outputs of the insurance firm. Within this financial intermediary approach, solvency can be a primary concern for regulators of insurance companies, claims-paying ability can be a primary concern for policyholders, and return on investment can be a primary concern for investors.

An examination of the efficiency of the marketing distribution channel and organizational structure for insurance companies is presented from a framework that views the insurer as a financial intermediary rather than as a “production entity” which produces “value added” through loss payments.

0 kommentar(er)

0 kommentar(er)